by Shannan Herbert, Chief Executive Officer of Wacif

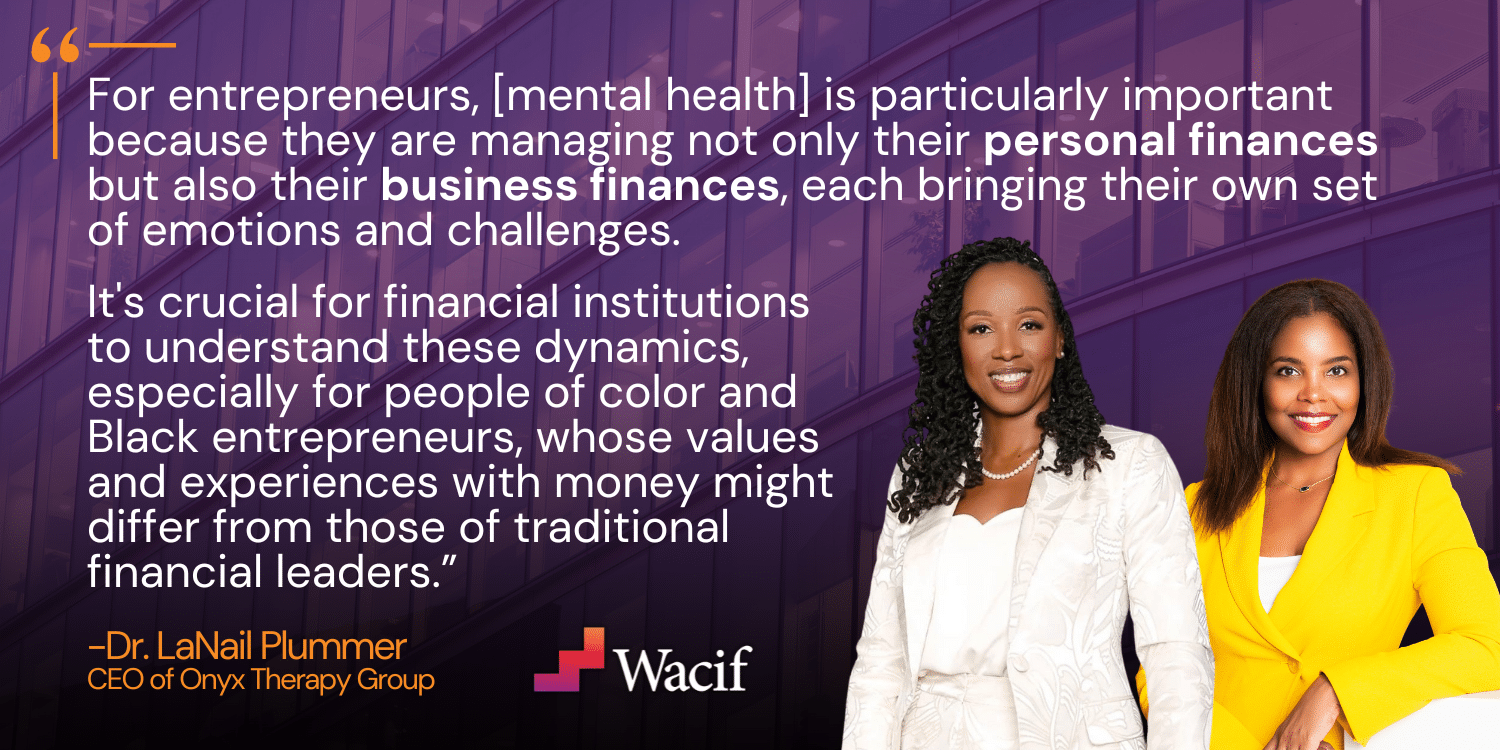

In recognition of Mental Health Awareness month, I sat down with Dr. LaNail Plummer, owner of Onyx Therapy Group to discuss money, trauma, and how we must engage with our small business community.

As a leading professional in the mental health field, Dr. LaNail R. Plummer is committed to improving the lifestyles of others through the aspects of mental health and character development. A United States Military Veteran and the CEO of Onyx Therapy Group — an organization she founded in 2013 — Dr. Plummer has over 16 years of experience working with a multitude of clients and specializing in the care of young women; the Black community; and members of the LGBTQ+ community. Grounded in the values of integrity and awareness, Dr. Plummer believes that emotional, spiritual, and cultural healing is attainable for all.

Shannan Herbert: Thank you, Dr. Plummer, for joining me for this discussion. Your expertise in mental health and its intersection with finance is incredibly valuable as we work to support small business owners. Let’s start with a broad question: Why is the discussion around mental health and money so important, especially as it relates to financial services?

Dr. LaNail Plummer: Thank you, Shannan. It’s a pleasure to be here. When I talk about mental health and money, I often begin by asking people how they feel on payday versus a few days before their next payday. This simple question helps people realize that money is deeply tied to our emotions—whether it’s joy and celebration when we receive it or anxiety and fear when we’re running low.

Money dictates our life experiences, especially in the United States. It influences what we can and cannot do, and these experiences bring with them emotions like shame, guilt, frustration, or confusion. Understanding our emotions around money can significantly impact our mental health, influencing our thoughts and behaviors.

For entrepreneurs, this is particularly important because they are managing not only their personal finances but also their business finances, each bringing their own set of emotions and challenges. It’s crucial for financial institutions to understand these dynamics, especially for people of color and Black entrepreneurs, whose values and experiences with money might differ from those of traditional financial leaders.

So, this conversation is especially important to me, as you described my intersections as a Black person who is a woman, an entrepreneur, and who understands mental health and money as well.

Shannan Herbert: That was very powerful. You and I have talked a lot in the past about financial trauma. Could you explain what financial trauma is and how it manifests for small business owners?

Dr. LaNail Plummer: Trauma, in general, is an experience so negative that it changes how we operate. Financial trauma specifically refers to negative past experiences with money that affect one’s ability to function optimally. This could include fear of not having enough money, fear of spending it, or not knowing how to manage it effectively.

For small business owners, especially Black women, financial trauma can be pervasive. It might stem from personal experiences or from witnessing their parents struggle with finances. This trauma can lead to fear of engaging with financial institutions, which in turn can prevent them from accessing the resources they need to grow their businesses. There is a huge shame in this country around being poor, as if people have elected or selected to be poor. The shame associated with not having enough money can be paralyzing, making it difficult for business owners to ask for loans or seek financial advice.

When it comes to entering a financial institution to ask for a loan, a business line of credit, or simply seeking advice on managing or investing their money, trauma could prevent individuals from asking the necessary questions or visiting the institution.

Financial institutions need to recognize this trauma and differentiate between customers who are cautious and those who are fearful. Cautious customers are still moving forward, albeit slowly, while fearful customers may be paralyzed or moving in the wrong direction.

Shannan Herbert: That’s an important distinction. How can financial institutions support small business owners who may be experiencing fear and how do we engage them?

Dr. LaNail Plummer: I’m going to talk about myself for a second here, Shannan.

I often joke that I’ve always been an entrepreneur, starting with opening a store in my middle school because I didn’t want my friends to go off campus and get detention. In this business now, Onyx Therapy Group, I needed more financial support as we expanded. We started here in DC and now we’re in Maryland, Pennsylvania, Virginia, Louisiana, and Johannesburg, South Africa. Some of the banks I worked with in the past saw me as just a number, not understanding my business’s community impact or the broader benefits of our expansion, such as enabling staff to buy homes or start their own businesses. When I worked with a bank who showed genuine interest, it helped address my financial trauma and foster trust, enabling our growth and mission fulfillment.

Financial institutions need to take the time to understand their audience. This means not just seeing them as numbers but understanding their businesses, their goals, and their challenges.

Building this trust requires more than a single interaction. It’s a journey that involves continuous engagement and support. Financial institutions should provide tailored advice and services that address the unique needs of their customers, especially those from Black and Brown communities.

Shannan Herbert: That’s perfect. You’ve really highlighted why the work we do at Wacif is so important. It’s because of the deep connection that we have with the community, that we’ve been able to establish lending relationships, provide accelerators, incubators, and technical assistance and advisory services to our small business community.

Because we do want to know. We do want to ask these questions. We want to know those things that you need help with, where we can be of service, where we can better assist you, where we can connect you with folks that can provide you with the advice and support that you need. Everything that you just described and what we do here is really about building trust. We must make sure that we’re building trust between our institution and the communities we serve, but we also understand that trust is not a point in time. It’s a journey.

So where do we begin? What does that trust journey look like and how does it start?

Dr. LaNail Plummer: Financial institutions may turn around and say, OK, Dr. Plummer, why do I need to know all of this information?

When we think about the statistics around the pandemic and who creates businesses in those moments of depression and times of needs or even financial lows is Black women. When a Black woman seeks a loan, it doesn’t just impact her individually; it resonates communally. As businesses seek investments, who better to support than those perpetually creating and fostering community connections?

People are asking, ‘Why do I have to invest in this business owner?’ Why should I care about their impact?’ The reason is simple: their word of mouth directly impacts your business, and they consistently contribute, which is vital for economic stability. This is especially true for Black women entrepreneurs, who often rely on their own resources to create opportunities and drive economic growth. Investing in the people who are consistent in creating and that consistency goes back to that trust journey, right?

This trust journey is different for Black women, as we haven’t always had access to financial institutions. Remember, it was only in the 1960s that civil rights for Black people and women’s liberation were established. We need long-established and new institutions to partner with us.

As a Black woman, I want to be celebrated for my creativity and innovation, and for these institutions to partner with me. I need their expertise to create something beautiful together. If I feel marginalized, it echoes past experiences and might make me walk away.

But where do we begin? We start with the higher-end process, particularly within financial institutions. They shouldn’t just seek individuals with expertise in finances or business management, but those who embody genuineness and authenticity. When staff authentically represent the institution, it fosters a welcoming environment for customers like me and fellow business owners to also be genuine. This process involves deconstructing outdated formulas and checklists to adapt to today’s needs. It requires restructuring and seeking expertise to align with the institution’s mission and values, especially in supporting diverse small business owners driving economic growth.

Shannan Herbert: This is such an important conversation because of our context and the communities we’re serving, particularly Black women entrepreneurs, whom you highlighted. How do we ensure that this conversation doesn’t stop here, but spreads widely?

Dr. LaNail Plummer: I mean, it’s really a matter of talking. Just people have to be willing to talk.

The challenge is that many are hesitant, fearing offense or judgment. Part of the way this conversation started today is from a panel where I discussed entrepreneurship and money. Those who can create awareness should do so through panels, podcasts, newsletters, and everyday conversations with neighbors, family, and children.

For financial institutions, these discussions should involve consultants and professional development. Ask questions like, “What are your thoughts on financial trauma?” and “How can we change operations to better support clients?”

People are often closed-lipped about money due to emotions like shame and fear. The key is to keep talking about money. Just keep talking.

Shannan Herbert: Thank you, Dr. Plummer, for your insights. This conversation is essential for creating a supportive financial environment for small business owners. Together, we can foster economic growth and mental well-being in our communities.

Established in 1987, the Washington Area Community Investment Fund’s mission is to increase equity and economic opportunity in underserved communities in the Washington, DC area by investing knowledge, social, and financial capital in low- and moderate-income entrepreneurs. Our mission is driven by three strategic pillars: inclusive entrepreneurship, community wealth building, and equitable economic development, and is fulfilled by providing access to capital products and services, and capacity building technical assistance to low- and moderate-income entrepreneurs. Wacif has been continuously certified as a Community Development Financial Institution (CDFI) since 1996, making the organization one of the nation’s first CDFIs.